Catalonia: New TPO-AJD measures (March 2025)

Taxes

The Diari Oficial de la Generalitat de Catalunya has published on March 26, 2025, the Decree Law 5/2025, of March 25, which introduces a battery of urgent measures in tax matters, with a special impact on the real estate sector. These reforms directly affect the Transfer Tax (TPO) and the Stamp Duty Tax (AJD), with effect from June 27, 2025, with some exceptions.

The following is a review of the main changes:

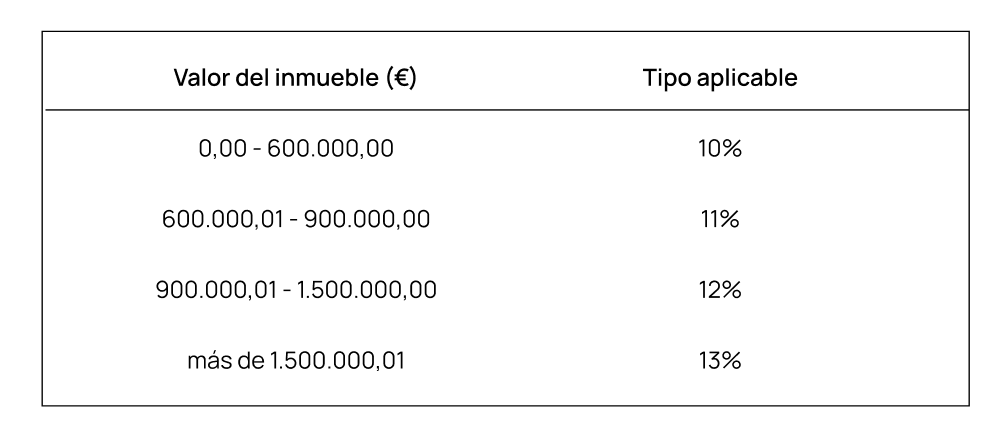

1. New rates in the general scale of the OPT

New scale of taxation:

2. 20% TPO on purchases of homes by large holders or entire buildings

One of the most striking measures is the introduction of a 20% TPO tax rate for certain cases:

- When the acquirer is a large holder, defined as:

- Owner of more than 10 residential properties or

- Owner of more than 1,500 m² of residential floor area, or

- Owner of 5 or more residential properties in stressed areas (according to the declaration of the Generalitat).

- When an entire residential building is acquired, with or without horizontal division.

- Exceptions: 20% will not be applied in the case of:

- Social developers (art. 51.2 Law 18/2007) or non-profit entities that provide housing to vulnerable groups.

- Real estate intended for the acquirer’s head office or place of business.

- Individuals acquiring buildings of up to 4 dwellings to be used as their own and their family’s habitual residence up to the second degree.

- In addition, a specific mechanism is regulated to apply this 20% rate to progressive purchases of buildings.

3. Extension of the reduced rate of 5%

The application of the reduced rate of 5% in TPO to acquire a primary residence is extended in the following cases:

- Young people up to 35 years of age (previously the limit was 32).

- Victims of gender violence, provided that their personal income tax base (after subtracting the personal and family minimums) does not exceed 36,000 euros.

4. New bonuses in TPO

Several bonuses affecting very specific sectors are approved:

- 100% on the acquisition of art or antiques for resale within one year.

- 100% for non-profit housing cooperatives that comply with Law 12/2015.

- 50% on purchases of:

- Office buildings or unfinished structures intended to be converted into subsidized housing.

- Real estate (housing, premises, industrial buildings) to establish headquarters or work center, with the following conditions: tax domicile in Catalonia and increase in workforce.

5. Elimination of the bonus for real estate companies

As of tomorrow, March 27, 2025, the 70% bonus of the TPO on transfers of homes to real estate companies for resale in three years will disappear.

This measure, in force for years, was a key tool for the rotation of assets in the real estate sector.

6. Increase of the AJD: from 2.5% to 3.5% in operations with waiver of the VAT exemption

When the purchase and sale of the property is subject to VAT and the VAT exemption is waived, the AJD rate will increase from 2.5% to 3.5%.

7. New AJD rebates

- 100% for deeds of purchase of primary residence by young people up to 35 years of age and income of less than 36,000 euros.

- 50% for:

- Deeds documenting the transformation of offices or unfinished buildings into subsidized housing.

- Mortgages formalized to acquire these properties.

- Acquisitions of real estate for company headquarters or work center (with conditions).

- 75% in deeds of incorporation of the horizontal property regime for plots in industrial or logistics parks, applicable until December 31, 2027.

Timetable for entry into force

- March 27, 2025: the elimination of the 70% bonus on TPO for real estate companies comes into effect.

- June 27, 2025: remaining measures, conditioned to the validation of the Decree-Law by the Parliament of Catalonia.